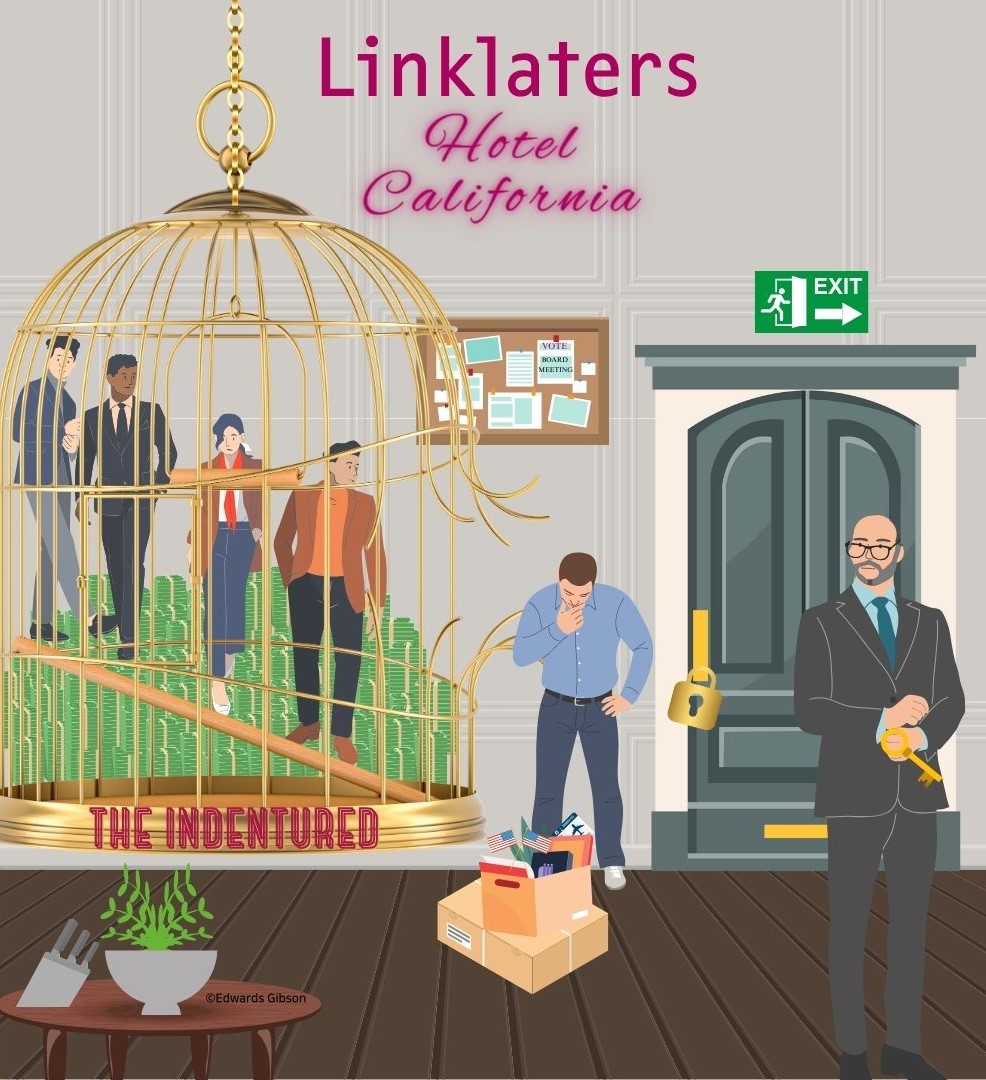

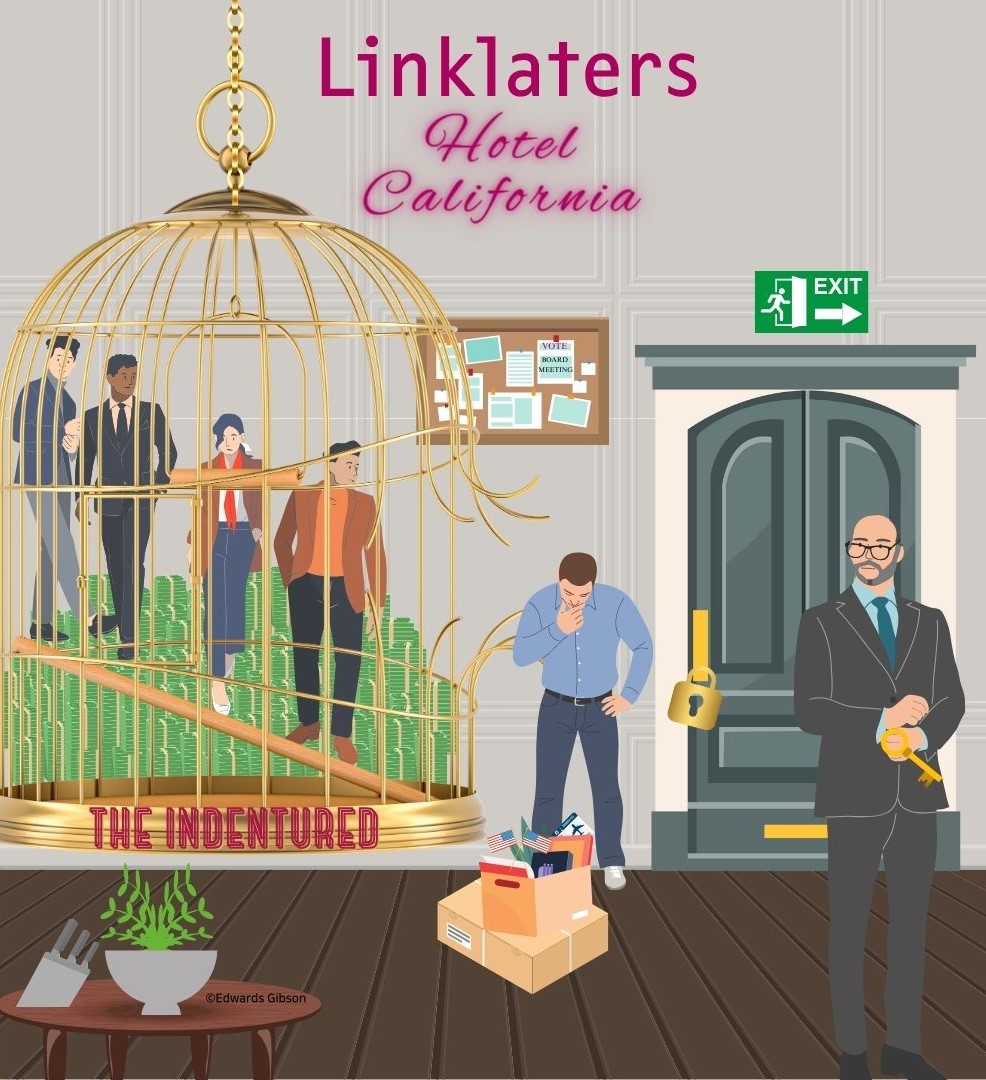

This week saw the shocking news that Magic Circle law firm Linklaters is seriously mulling changing its compensation structure so as to enable it to withhold retained profit distributions of partners who leave for competitor law firms – importantly, this will seemingly be the case even if exiting partners are not in breach of any covenants! According to The Lawyer , this would be the first time a UK firm has granted itself that power. Regardless of whether that is actually correct, some Linklaters partners feel that, if voted in, at a stroke, the once coveted badge of “partner” will become something akin to indenture – a form of Big Law serfdom. Indeed, that an Al Capone-like approach to partner management, “Nice distributions you’ve got there, it would be a shame if anything were to happen to them”, is even being contemplated by a firm which purports to be in the global elite tells us just how tarnished the once mighty Magic Circle brand perceives itself in its home market.

The idea is being mooted as a direct response to the high number of lateral partner departures the firm has suffered, predominately to elite US law firm rivals. Whilst it is true that, in London, Linklaters did lose a record dozen partners to competitors last year, as we said in the 78th edition of Edwards Gibson’s Law Firm Partner Moves, only 9 of the departures were partners that the firm would have preferred to keep, moreover, far from being a hapless victim, Linklaters itself hired 6 lateral partners (including 3 from US rivals Kirkland & Ellis, Latham & Watkins and Shearman & Sterling). So, for a firm with 500 odd partners, Linklaters tallied a net real loss of just 3 partners in London, and even then, two of these were to the re-launched London office of Paul, Weiss, Rifkind, Wharton & Garrison LLP - a firm so rapacious that it ripped no fewer than 10 laterals from that former apex predator of Big Law, Kirkland & Ellis.

Yesterday’s news that Linklaters is to lose a third partner, Dan Schuster-Woldan, to Paul Weiss does not change the fact that law firm partner lock-ins smack of desperation and are associated with extreme weakness – think Hammond Suddards or SNR Dentons in the bad old days. Even if withholding distributions is not practical (or enforceable) in all jurisdictions, a “Hotel California” approach towards partnership where, as the song goes, “you can check out anytime you like but you can never leave”, will damage the brand and cause all laterals, but especially those at US law firms in London, to think twice about joining. This is because most elite US law firms pay final profit distributions very shortly after the end of the financial year in which it was earned; in contrast, most UK law firms generally withhold profits and distribute them in aliquots over the following 12 months (i.e. in arrears). So, even where headline compensation is the same, this cashflow disparity already puts UK law firms at a disadvantage when poaching US law firm laterals … if one adds in the concept that those (already delayed) distributions can be negated altogether, you have the law firm equivalent of a cold cup of sick!

It is unfortunate for Silk Street that this story leaked, and to some extent the damage has already been done, however, Linklaters should quietly drop the idea, blame it on miscommunication, and swiftly move on. As noted in our report, last year was a record year for partner hires spurred on in large part by, sometimes dramatic, countercyclical investments by US law firms in private equity related grabs for talent. The underlying market for legal services, and private equity driven deals, was relatively soft, and will remain so whilst interest rates remain high (or “normal” in old money) so it is unlikely that the intensity of lateral hiring will remain quite as elevated; at some point soon, those expensive investment hires by US law firms will need to see a return and, right now, it’s hard for PE houses to achieve the leverage that they need to generate the truly gigantic returns which make its co-invested lawyers rich. Indeed, with money no longer the cheapest it has ever been in the history of humanity, who knows, it may just be that those days never quite return; probably no bad thing for the Magic Circle, which generally doesn’t have quite the same “ins” with the US private equity houses that make the market.

In the meantime, Linklaters will inevitably lose a few more laterals to US firms (ironically some spurred on by the very action that Linklaters is considering). Inevitably, Paul Weiss, a firm whose London office is now stuffed with Linklaters alumni (many of whom came by way of Kirkland & Ellis), may well strike again; I suppose Linklaters partners could always “stab it with their steely knives” but I’ll bet “they just can't kill the beast”. Regardless, a lock-in is not the answer.

©Edwards Gibson 2024

Please do not hesitate to contact us if you would like to discuss this article or any other aspect of the market in more depth.

Scott Gibson, Director scott.gibson@edwardsgibson.com or +44 (0)7788 454 080